Follow India Renewable Energy News on WhatsApp for exclusive updates on clean energy news and insights

Declining Interest in Firm and Dispatchable Renewables (FDRE) and Its Impact on Energy Storage in India

Mar 05, 2025

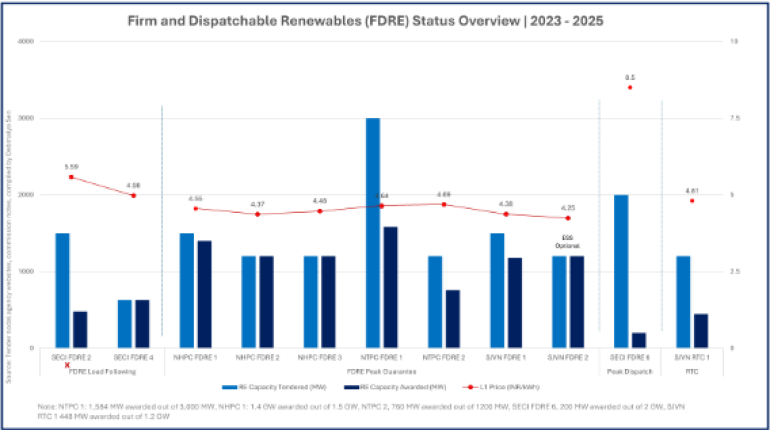

The concept of Firm and Dispatchable Renewables (FDRE) in India was expected to significantly drive energy storage adoption, but recent trends suggest diminishing interest. Two commissioned projects—NTPC FDRE 1 (1530 MW) and SJVN FDRE 1 (2234 MW)—have demonstrated an average 12% energy storage integration within their oversized renewable energy (RE) portfolios.

NTPC’s project requires 3499 MW RE capacity with 415 MWh energy storage, while SJVN’s setup involves 5960 MW RE with 664 MWh storage, priced between Rs4.45-4.72/kWh.

The key design strategy behind FDRE projects involves oversizing the RE portfolio by 2.5 times, with wind capacity exceeding solar by 1.5 times. However, this approach is facing challenges as investor interest in FDRE models is declining. The low response to tenders reflects this shift: for instance, SJVN’s 1200 MW RTC tender received bids for only 560 MW, of which 448 MW was awarded. Similarly, SECI’s 2 GW peak power tender saw just 200 MW awarded.

The rise of alternative storage solutions—such as solar + battery energy storage (BESS) and standalone energy storage—is diverting focus from FDRE. These alternatives offer better predictability and financial returns, making them more attractive for developers.

Currently, India has floated 21.4 GW of FDRE tenders, with 4.9 GW under bidding, 8.2 GW awarded, and 3.9 GW under execution. However, in the last two months, no new FDRE tenders have been issued, signaling a shift in priorities toward more flexible and economically viable energy storage models.